It’s advisable that you know whom part of the team is actually because of it service to help you always’re using a trusted service after they appear on your own cellular cellular telephone expenses. When you use debt establishment’s official software, all economic information is safely encrypted. Your own personal information is turned an unreadable code since it is sent to your lender electronically.

Manage Pay By the Mobile casinos take on almost every other banking procedures? | online baccarat pro series real money paypal

But not, the amount of money is almost certainly not readily available for a couple of hours to help you a short while, based on the seller’s regulations. However,, the newest deposit limitations about this ability will get swing the option of the lending company. You might log in to the fresh app and you will access your own membership safely 24/7 using the most advanced technology and Contact ID and you will unmarried-fool around with security requirements. Same as no-deposit bonuses on the favorite gambling enterprise, no-deposit bonuses to the cellular is exactly the same which have the brand new exclusion from stating it via cellular. These incentives are also considering since the greeting incentives and they are readily available inside the Screen, Android or Apple ios products.

Please comment its terminology, privacy and you may shelter rules to see the way online baccarat pro series real money paypal they apply to you. Pursue isn’t responsible for (and you can cannot give) any items, features otherwise articles at this third-people web site otherwise software, apart from services and products you to definitely explicitly bring the new Chase term. See how easily you could deposit a check from their mobile phone — quickly, conveniently, sufficient reason for cellular deposit inside our cellular financial app.

Correspondent Services

For additional facts, see TD Bank’s Fund Availableness plan. Deposit the bucks into the partner otherwise pal’s membership and they’ve got the brand new liberty to pay the bucks to your calls or other communications functions available at their studio. In such cases, the funds obtained’t be available until following the lender ratings the brand new put. Immediately after our opinion, you can aquire a page from the post on the choice. To begin with, name one of many playing financial institutions otherwise borrowing from the bank unions noted on the brand new VBBP webpages.

Very first, ensure that your bank or borrowing partnership also offers cellular consider deposit. Whether it really does, the website will often render an install link to the brand new bank’s mobile application. Obtain the fresh software to a smart phone that have a camera—Android, new iphone, and you may Screen gadgets are typically served. Range from the bank’s web site to provide you with the new legitimate application alternatively than an enthusiastic impostor. Definitely realize and you can understand the provider’s principles prior to using the newest mobile put element to stop people points otherwise waits.

To have parents having kids and you will family, discuss Pursue High school Examining℠ or Pursue First Financial℠ because the a free account that can help moms and dads train decent money habits. All of our Pursue University Checking℠ account features great benefits for college students and you will the new Chase examining customers can take advantage of it special offer. Mobile view put are a help that enables one deposit a check into your membership with your smart phone without in order to individually go to an area individually. GTL’s Deposit Solutions create efficiencies when taking dumps, remove correctional facility will set you back, and increase the ease to own friends and family participants. GTL offers a broad number of points to select from so your proper mix might be created for all studio.

Rebecca River try a certified teacher inside the private financing (CEPF) and you can a financial expert. She’s already been dealing with personal finance while the 2014, and her works provides starred in several publications on line. Past financial, her possibilities discusses borrowing and you may personal debt, student education loans, paying, real estate, insurance and small business. Yes, you can since the all of the Pay By Mobile choices only lets places. Which means you will be motivated to pick some other percentage method when your request a detachment.

- For those who discovered a that isn’t produced off to your, best behavior should be to have the look at endorsed from the payee and then placed into their individual account.

- You could potentially deposit inspections in the account by just delivering a image of your own report take a look at utilizing the mobile application.

- Abreast of request of Bank otherwise Merrill, you’ll timely deliver the Goods to Lender otherwise Merrill throughout the the new Storage Several months.

- Chase on the internet lets you manage your Chase account, look at statements, display pastime, pay bills or import financing securely in one main lay.

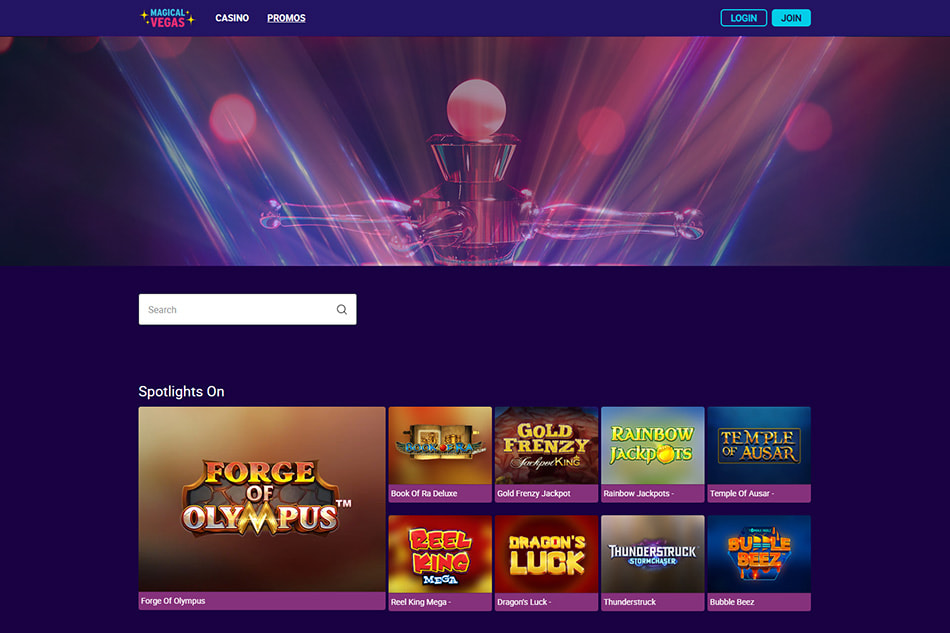

- You could potentially visit one of those internet sites and choose games from their checklist.

- There are even other stuff you could delight in as you gamble within the an internet local casino.

- The fresh legal rights and commitments here will join and you may inure on the advantageous asset of any assignee.

ET cutoff day will be experienced obtained to the after the company time. Chase QuickDeposit offers an instant and simple way to put inspections via the Pursue mobile software, saving you away from being forced to check out a financial part otherwise Automatic teller machine. For those who’re fresh to Chase, you might have questions relating to the app performs.

How to establish direct put?

- Consider both benefits and drawbacks before carefully deciding if the pay because of the mobile phone ‘s the right choice for you.

- Consider eligibility, keep attacks and you will costs because they can differ of inside-part financial.

- Including, the fresh Wells Fargo cellular software shows you their mobile deposit limit when you see an account and you may go into the need put amount.

- For example, Lender away from The usa also offers mobile consider places and generally techniques fund getting readily available next business day.

- Finance are usually readily available after deposit but can possibly capture numerous working days to pay off.

- We are seriously interested in generating in charge playing and you may elevating feeling in the the newest you’ll be able to risks of gaming dependency.

For individuals who already have the mobile bank account install, log in to mobile financial. Discover cellular view put for action with our entertaining training. Definitely keep your register a safe venue until you comprehend the complete put number listed in your account’s previous/current deals. After you do, make sure to destroy the fresh look at instantaneously because of the shredding they otherwise using some other secure strategy. There is certainly a monthly restriction for Cellular Take a look at Dumps and it is demonstrated once you discover their put membership.

One of the biggest advantages of cellular financial, and especially mobile look at deposits, ‘s the self-reliance that it brings. You are no more linked with an actual place for a key part of debt means, and many banking companies render this service with no more charge. From the banking community, this type of electronic purchases are described as secluded put get. They’re also processed individually from the lender’s digital system, as well as the investigation you send out are included in encryption.

Navy Government Information

Cellular deposit try a way to deposit a as opposed to in person visiting the bank. That with a smart phone having a camera—such a mobile or a tablet—it’s not hard to get a graphic of the consider, which is up coming published from bank’s mobile app. Cellular deposits are removed within a matter of days. Attempt to look at the banking arrangement for the direct form of checks your own establishment usually approve to have mobile deposit. Most will let you deposit private monitors, organization monitors, and you can regulators inspections.

That way, there is the check up on turn in situation anything goes wrong during those times. When you check and upload the new photos of the look at and you can fill out the put consult, all the details is actually encrypted and you may carried on the bank. The new take a look at then observe the standard steps to have handling and you can clearing so that the fund is also deposit into the account. If you’d like to adhere similar commission procedures only using their mobile, you can test Siru Mobile, PayForIt or Boku.

Friend now offers simple, free and you will safer online take a look at dumps as a result of Friend eCheck℠ Deposit. Like almost every other banking institutions, Friend features several limitations like the take a look at must be dated within the last 180 months and you will put up in order to $fifty,100 instantly or more so you can $250,000 the 31 schedule weeks. If you were a friend customer for more than 29 months, you’ll receive much more fast access to your money and that is of use if you wish to build quick payments. Simultaneously, mobile consider dumps are available as a result of on the internet-merely banks for example Friend and you may SoFi, as well as of many borrowing unions. To the rise of electronic banking, customers is now able to complete of a lot common banking services online otherwise having fun with a good bank’s mobile software, along with deposit inspections.