If you’re looking to own a more outlying and you can suburban lifetime – where in actuality the cost of living is normally lower – good USDA home loan will save you cash on your own down payment and you will interest rate.

The ability to works remotely has generated a different sort of opportunity to alive everywhere you want. While the COVID-19 limitations try more sluggish brought up, more a third from personnel report continuing to your workplace regarding home aside from the workplace opening back-up.

There can be a single procedure – to find a good USDA home loan, you should look for an eligible assets. This is when the new USDA home loan chart comes in.

What is actually a beneficial USDA Financing, and exactly how Are you willing to Make an application for You to?

Mortgages regarding the You.S. Company out-of Agriculture try financing that will be designed to service reduced-income family to find sensible homes outside of big metropolises. This type of loans are often a good option to own individuals whom would not if you don’t be eligible for a classic mortgage.

The initial benefit of a beneficial USDA mortgage is the fact it generally does not require an advance payment – which may be the most significant economic burden so you can homeownership. Brand new money focus on to own 29-season terms and conditions during the repaired interest rates (a bit lower than old-fashioned money) and will be used to pick proprietor-occupied, single-family homes and you can apartments.

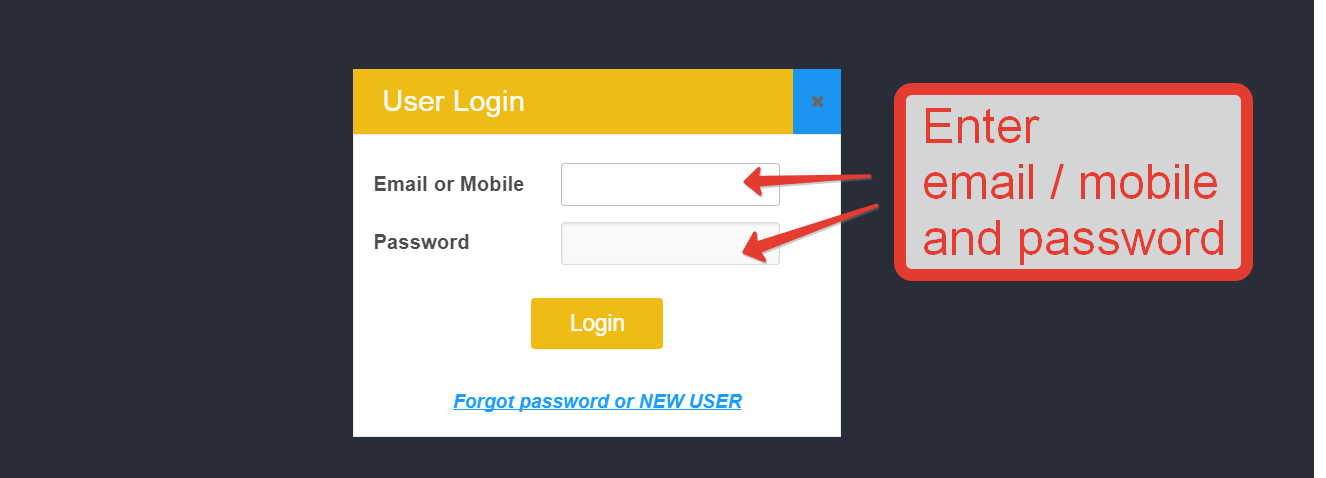

The brand new USDA application for the loan procedure starts with determining their qualifications, and that utilizes your earnings, credit score, and other personal debt. For people who be considered, you can work at an excellent USDA-acknowledged lending company to safer a home loan pre-acceptance and begin seeking USDA-accepted belongings.

Qualification Requirements to own USDA Lenders

New terms of an excellent USDA financing is going to be high, however, they aren’t for all. To make sure you have a tendency to be eligible for you to definitely, you’ll want to meet with the pursuing the criteria:

- Your income should be inside 115% of median family income restrictions specified to suit your urban area

- You should be a You.S. Citizen, You.S. non-citizen federal, or qualified alien

- You will likely you would like a credit score out of 640 or over

- Debt obligations shouldn’t meet or exceed 41% of pre-income tax earnings

- You should commit to individually undertake the dwelling as your primary household

- It should be discovered contained in this an eligible rural urban area

- It ought to be one-loved ones hold (which includes apartments, standard, and you can are made land)

- There is absolutely no acreage restriction, nevertheless property value the brand new residential property ought not to surpass 30% of the value of the home

Pro Suggestion

Before you could get hooked on your possible family, browse the USDA entertaining chart to see if it’s qualified.

What Qualifies because the a beneficial Rural Urban area

One which just adore one style of household, you’ll need to see and this components in the area qualify towards USDA program. How USDA defines rural parts relies on your area.

Typically, such portion is actually defined as discover country that is not part of, associated with the people area, said Ernesto Arzeno, an interest rate founder which have American Bancshares.

The new rule of thumb was components having an inhabitants having less than just ten,100000, Arzeno said, in the event that laws is not hard and you will quick. For almost all elements, based on homeownership cost, the latest USDA lets populations up to 35,000, but do not greater than that. Together with designations could possibly get change since USDA studies him or her all of the long-time.

The way you use the fresh USDA Home loan Chart

This new USDA’s entertaining financial map ‘s the device that allows the truth is if a property is approved. It functions in 2 suggests: You can search physically to the address regarding property you are considering, and it’ll make you an answer about eligibility. Or, you can navigate in the chart to determine what areas fundamentally are thought outlying.

- Unlock this new USDA Mortgage Chart here.

You’ll find that with this specific chart is not therefore unique of using Google Charts and other similar units. But listed below are some things to remember when using the USDA mortgage chart:

Try a USDA Home loan Good for you?

USDA Lenders is good pathway so you’re able to homeownership, especially if you are searching to call home away from a large city. However with any financing, you can find pros and cons. This is what to adopt.

A monthly financial support fee (like personal mortgage insurance policies) was set in the loan percentage. It cannot be terminated immediately following reaching 20% collateral.

It is important to focus on the brand new financial cons. Missing a deposit form you’ll have an enormous loan total shell out focus towards. As well as, a monthly financing fee will apply for the full duration of people USDA financing. With that, make sure you think the mortgage money choices to select and therefore will be the most useful complement you.