Only a few expenses have been made equivalent. Regarding buying a property, particular bills are a good idea and several, really, we can do in place of. Why don’t we browse the different types of financial obligation and you may how they you’ll connect with your home mortgage borrowing from the bank skill.

Unsecured loans and you can covered auto loans

Consumer loan financial obligation decreases the quantity of money you must provider home financing, therefore probably cutting your borrowing from the bank potential. Signature loans as well as usually have highest interest rates. When the an adjustable interest rate are connected with the loan, lenders may increase a barrier to allow for future rate of interest rises.

Protected auto loans constantly render straight down interest rates than unsecured private funds as financing signifies a lower risk on lender. Because of this if you find yourself a guaranteed car loan usually nevertheless affect the borrowing from the bank potential, may possibly not has as the large an impact while the an enthusiastic unsecured personal bank loan.

On the other hand on the, a totally reduced car loan can help the application. Indicating you were capable constantly help make your car finance costs timely will make your property loan application healthier.

College student loans

Your income as opposed to your expenses models a big part of your own financial application investigations. Unlike really expenses, scholar debt impacts money side of the formula. Just like the at , given that minimal fees money threshold are met, the latest fees pricing initiate within 1% of the income while increasing because you earn significantly more, around all in all, ten% of your own income. Just how much you earn find just how much you only pay straight back, and as a result, the result it obligations has on your own borrowing from the bank potential. Certain lenders get evaluate student loans in another way, however, no matter what it love to address it, college student loans can have some affect the borrowing power.

Present mortgage

For individuals who already own a property well-done! This is certainly such as for example a sensational end. No matter if buying your first home could have kept you that have a beneficial large amount of debt, it is not all of the not so great news! If you’ve lived in your property for a while it’s also possible to have the ability to tap into the security to help make a much bigger deposit to suit your 2nd possessions. One earnings off money functions you are going to increase your borrowing low interest rates for personal loans FL capabilities and you can assist the loan app.

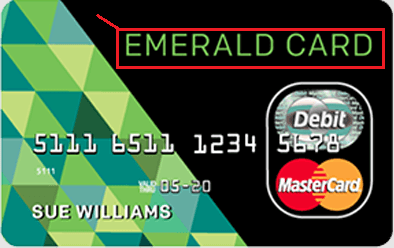

Personal credit card debt

Credit card debt can be extremely confusing, and there is many conflicting pointers doing their affect getting home financing.

It’s preferred to listen one credit cards will help improve your credit history. While not a whole myth, an even more exact declaration would be that credit cards can help change your credit rating if you’re in control. Using playing cards sensibly will help demonstrate to lenders you might be a beneficial credible, low-exposure debtor. How you spend other repeated expenses, such as cell phone bills and even fitness center subscriptions, also can join your credit rating. For more information on credit scores and also to find out how you will get a totally free duplicate of yours, visit ASIC’s Money Smart web site.

Lenders do not just look at the charge card balance and repayments. What is also essential on it ‘s the credit limit each and every credit. For those who have numerous playing cards and you can consider this may connect with your borrowing power, it could be a good idea to consult with a lender and explore closing certain card membership otherwise decreasing its limitations to help you find out if it will help your property loan application.

Mutual debt

If you have taken out financing that have someone else this will make your a good co-borrower, and really loan providers your co-debtor was one another as you and you will really liable for the debt. Thus if the other individual is actually struggling to pay-off the mortgage, you may be after that fully accountable for the new an excellent harmony (and you can the other way around). This doesn’t number if for example the people you display the loan with may also be towards financial. However if they’re not, one debt represents every your very own which you will notably connect with their credit ability. When you are in cases like this and wish to alter your borrowing from the bank skill, particular loan providers is willing to only take under consideration the express of your own debt if you’re able to render evidence others co-borrower pays theirs.